Introduction

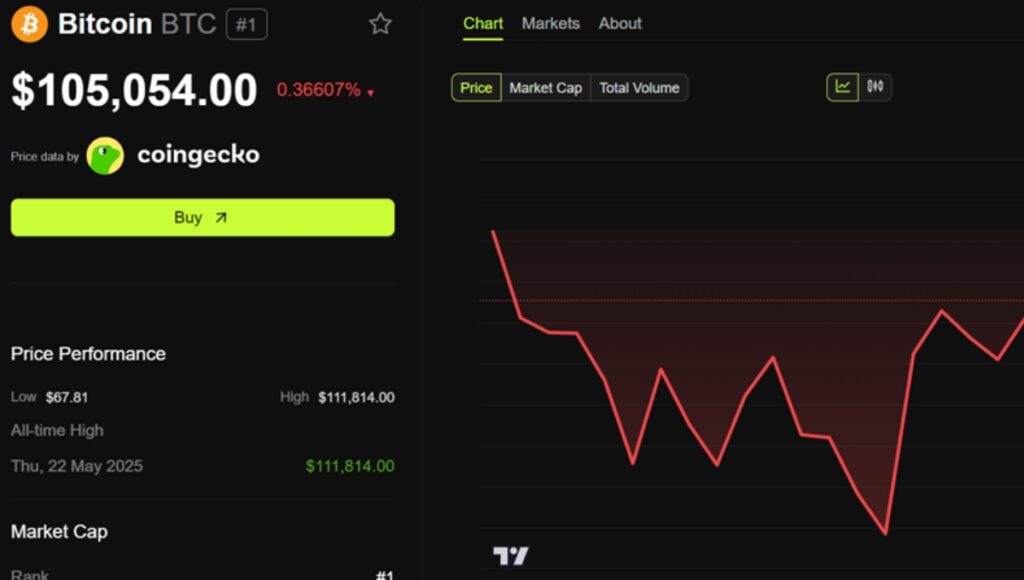

Bitcoin has once again captured global headlines, reaching a fresh record high of ₹1,18,780 this week, after breaking through its earlier resistance of ₹1,11,970 just days earlier. The surge has largely been fueled by institutional participation, particularly through spot Bitcoin Exchange-Traded Funds (ETFs), which saw inflows worth a staggering $2.72 billion in just one week.

Yet, despite this unprecedented momentum, one curious phenomenon stands out: retail investors remain surprisingly quiet. Unlike the frenzy of 2017 or the euphoric rallies of 2021, this bull run feels distinctly muted among everyday traders. Search interest in Bitcoin remains low, online chatter is restrained, and new retail entrants are almost invisible. This disconnect between institutional enthusiasm and retail hesitation is raising questions about the true nature of the 2025 Bitcoin rally.

Bitcoin’s Price Journey in 2025

The year 2025 has proven to be historic for Bitcoin. After consolidating around ₹85,000 in early May, the cryptocurrency gained steady traction before breaking through the six-figure mark in June. The real fireworks, however, began in July, when ETF inflows sent prices soaring past all previous records.

Table: Bitcoin Price Milestones in 2025

| Date (2025) | Price (₹) | Event / Trigger |

|---|---|---|

| 12 May | 85,200 | Institutional accumulation |

| 18 June | 1,01,000 | ETF-driven rally begins |

| 10 July | 1,11,970 | Breaks previous ATH |

| 12 July | 1,18,780 | New record high |

This rise mirrors past bull cycles, but the tone feels different. In 2017, retail mania drove Bitcoin’s meteoric climb to $20,000. In 2021, institutional investors joined the party, but retail activity still remained strong. In contrast, the 2025 rally appears to be institution-led almost entirely, with the general public standing on the sidelines.

Institutional Push: The Role of ETFs

The real engine behind Bitcoin’s recent surge has been spot ETFs. According to market trackers, Bitcoin ETFs attracted $2.72 billion in fresh inflows between 6 July and 12 July — the largest weekly inflow since their launch.

Table: Weekly Bitcoin ETF Inflows (June–July 2025)

| Week Ending | ETF Inflows (USD Billion) |

|---|---|

| 22 June | 1.05 |

| 29 June | 1.48 |

| 6 July | 2.10 |

| 12 July | 2.72 |

Institutional investors — pension funds, asset managers, hedge funds — prefer ETFs because they provide Bitcoin exposure without the technical complexities of custody and wallets. This financialization of Bitcoin has made it easier for large players to deploy billions, thereby driving the price to new highs.

Google Trends vs Market Reality

While institutions are piling in, retail interest seems remarkably low. Google Trends data reveals that searches for “Bitcoin” increased by just 8% between 29 June and 12 July. For comparison, in November 2024, after Donald Trump’s election victory, Bitcoin searches surged by 60% when the coin crossed ₹1,00,000.

Table: Google Search Trends vs Price Moves

| Period | Price Movement (₹) | Increase in Google Searches |

|---|---|---|

| Nov 2024 (Trump win) | 1,00,000+ | +60% |

| Jul 2025 (ETF inflow) | 1,18,780 | +8% |

This contrast highlights the gap between institutional participation and retail curiosity. It suggests that while the big money is flowing in, the broader public either doesn’t know, doesn’t care, or doesn’t believe in the sustainability of the rally.

Retail Investor Sentiment: Fear of Missing Out or Fear of Loss?

Crypto commentators believe retail hesitation comes down to psychology. Lindsey Stamp, a well-known analyst, argues that when ordinary investors see Bitcoin priced at ₹1.17 lakh, they assume the opportunity has already passed. “People think they’ve missed the boat,” she explains.

Cedric Youngelmann, host of the Bitcoin Matrix podcast, adds, “Retail investors will wake up only when it’s too late. They’re waiting for a dip that might never come.”

Retail investors appear paralyzed between two fears: the fear of missing out (FOMO) if they don’t buy, and the fear of loss if they do buy at what feels like a peak. This psychological trap explains much of the retail silence despite soaring prices.

On-Chain Insights: Is Retail Already In Through ETFs?

Another possibility is that retail investors are entering Bitcoin indirectly, via ETFs, rather than buying coins on exchanges. If retail investors are buying ETF shares through their brokers or retirement accounts, on-chain data might fail to capture this activity.

This raises an important question: are retail investors really absent, or are they simply invisible in traditional metrics? Cointelegraph recently suggested that ETF ownership could be masking retail participation, creating the illusion of institutional dominance.

Expert Opinions: Is This Rally Sustainable?

On-chain analyst Willy Woo believes this rally is far from over. “We’re just getting started,” he said in a recent note. He points out that ETF inflows remain strong, miner reserves are declining, and liquidity on exchanges is tightening — all signs of continued upward momentum.

Other experts share a cautiously optimistic view. Some warn that without retail participation, the rally could lack long-term stability. Others argue that retail will inevitably join once prices move higher, creating a second wave of buying pressure.

Historical Lessons: Past Bull Runs vs 2025

History offers useful comparisons.

Table: Comparing Past Bitcoin Rallies

| Year | Driver of Rally | Retail Participation | Outcome |

|---|---|---|---|

| 2017 | Retail mania | Extremely high | Burst bubble at $20k |

| 2021 | Institutional + retail | High | Correction after $69k |

| 2024 | Political catalyst | Moderate | Spike post-election |

| 2025 | Institutional (ETF-led) | Low | Ongoing rally |

The difference is clear: 2017 was retail-led, 2021 was mixed, but 2025 is institution-driven. This shift could make the current rally more resilient, as institutions are less likely to panic sell than individual traders.

Global Perspective: Adoption & Regulation

The Bitcoin rally is not unfolding in isolation. Around the world, governments and regulators are grappling with crypto adoption.

In the United States, ETF approval has legitimized Bitcoin in the eyes of mainstream finance. In Europe, regulatory frameworks are making it easier for funds to allocate crypto. In Asia, countries like Japan and South Korea are seeing renewed demand, while India continues to debate taxation and compliance measures.

Meanwhile, central banks are advancing their digital currency projects (CBDCs). Far from competing directly, these projects seem to reinforce Bitcoin’s narrative as a decentralized alternative.

Future Outlook: What Will Bring Retail Back?

The big question is what it will take for retail investors to return. Analysts point to three possibilities:

- Price momentum: If Bitcoin crosses ₹1,50,000, retail enthusiasm could reignite.

- Education: More awareness campaigns may reduce fears of volatility.

- ETFs as a gateway: Retail investors may gradually shift from ETF exposure to direct holdings once they feel comfortable.

Some forecasts suggest Bitcoin could reach ₹2,00,000 by the end of 2025 if ETF inflows continue at their current pace. If so, retail silence may not last much longer.

Conclusion

Bitcoin’s 2025 rally is unlike any before it — driven almost entirely by institutional flows, supported by ETFs, and marked by an eerie absence of retail participation. While the silence of the crowd feels unusual, it may only be temporary. History shows that once momentum becomes undeniable, retail investors tend to rush in, often at the tail end of rallies.

For now, institutions are leading the charge, rewriting the narrative of Bitcoin as a legitimate financial asset rather than a speculative toy. But the story is far from over. Retail investors may yet re-enter the stage — whether as cautious ETF buyers or as bold crypto traders — and when they do, the dynamics of this rally could shift dramatically.

Disclaimer

This article is intended for informational purposes only and should not be taken as financial advice. Cryptocurrency investments are subject to high market risks and volatility. Readers are strongly advised to conduct their own research or consult a financial advisor before making investment decisions.